So, are we having fun yet? We are rip-roaring knee-deep in correction territory, with the Federal Reserve’s commitment to taming inflation stifling the economy with higher interest rates. Rates permeate all segments of the economy, including car leases, corporate capital investments, HELOC loans, and real estate purchases. It’s part of the economic cycle; if you didn’t plan for it, you should brush up on your college Macroeconomics 101.

We planned for it, and just as I thought, real estate came to a screeching halt six months ago when the first of five rate hikes hit the Market. It amazed me how surprised most people were. The Feds have been signaling the hikes for a long time. It’s inevitable and follows the patterns of historical business cycles over the past 50 years. Since then, Lynn and I have been on a semi-official vacation, recharging our batteries and getting ourselves ready for the upswing.

And here comes the upswing. We’ve been busy in November and December, preparing several new listings for January launches. Unfortunately, I’m unable to mention them here due to the new Clear Cooperation Policy, but if you’re interested, call me or email me and I’ll tell you what we have coming.

The basics of real estate haven’t changed, and it remains a psychological game of cat and mouse between buyer and seller. Real estate is a slow and steady process, so intelligent buyers are driving tough bargains, knowing that they will be stuck with a higher rate on their note for just a few years before rates start declining again and they can refinance their mortgage. What does a year or two mean in the big scheme of things when you will likely hold onto your property for ten years or more?

I made a statement that requires some definition; How much “negotiating power” do the buyers have right now? A lot, and I mean a lot. If you are a seller and you must sell for whatever reason, the buyers can sniff that out and push you to the limit if they have a wise enough agent. For example, my sister and I just purchased a four-unit building, and the seller’s agent was kind enough to tell me that her clients needed to close on time because they were wrapped up in an IRC1031 exchange. (You can bet I took advantage of that little parcel of information.)

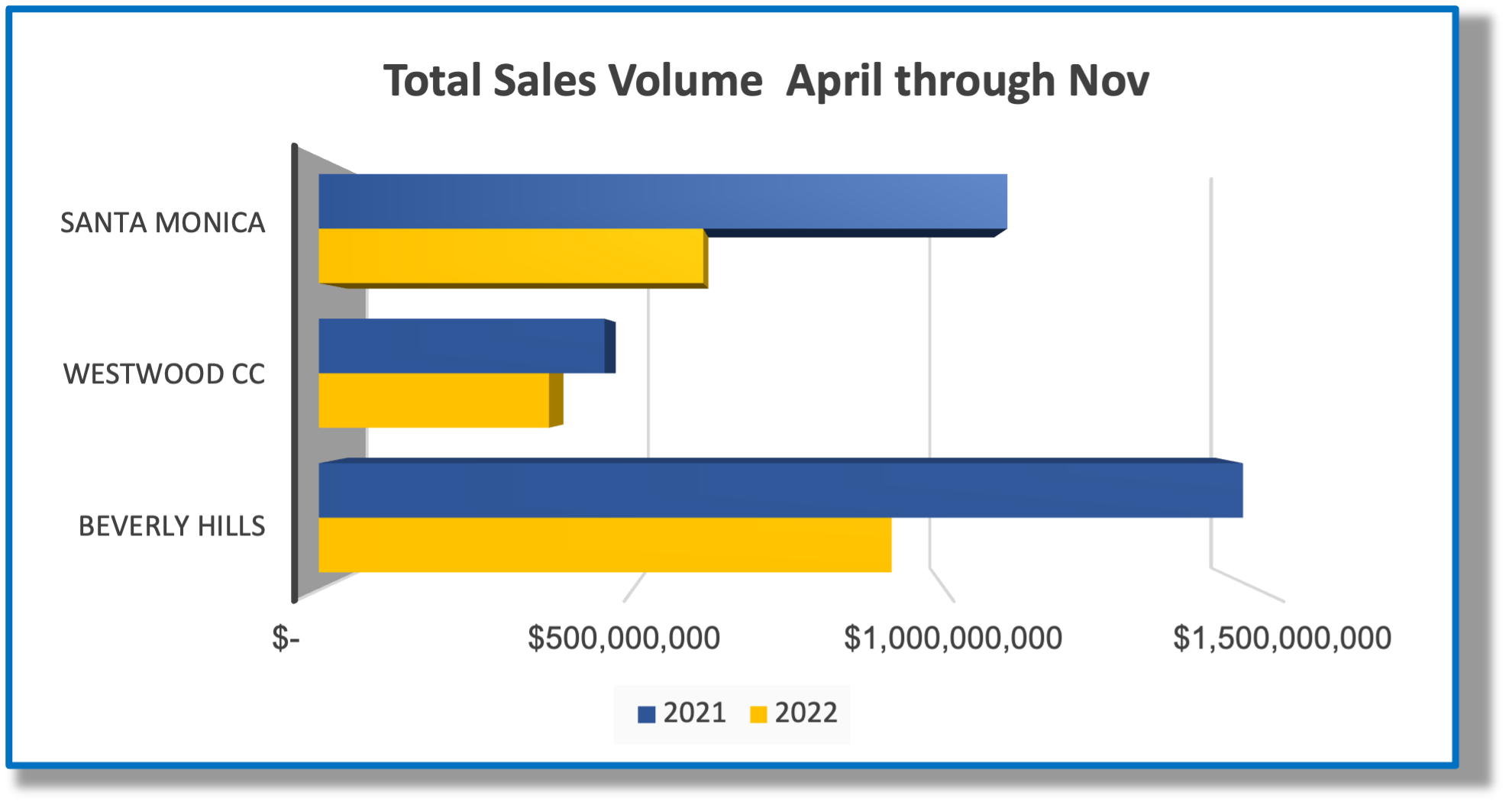

Let me show you what I mean by comparing April to Nov 2022 with the same period in 2021. I chose this window because April of 2022 was when our world started to collapse with a drop in the stock market, bond prices moving in the wrong direction, and interest rates on all types of loans increasing rapidly.

Consider this:

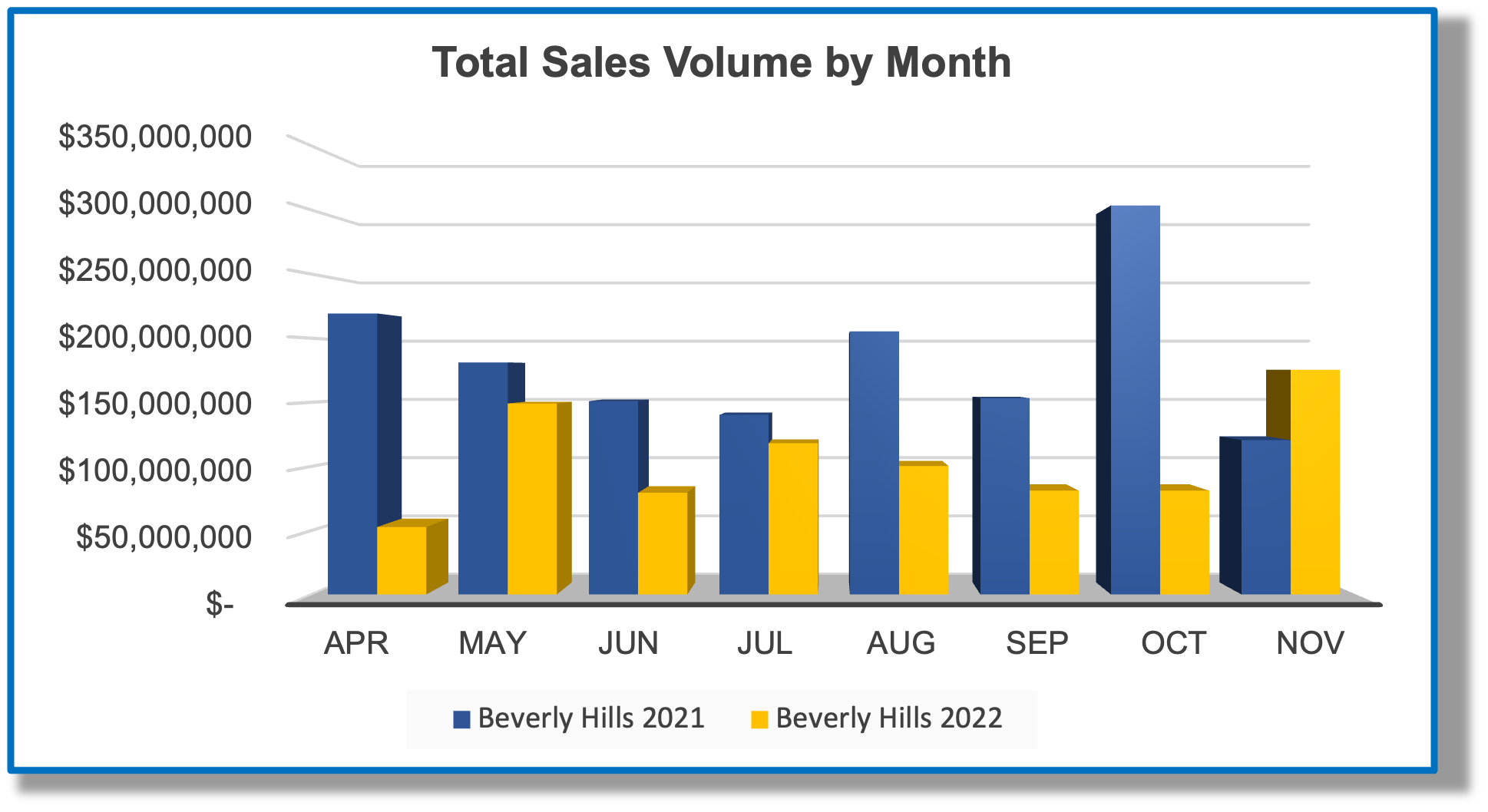

In Beverly Hills, the number of closed sales during that period dropped from 160 to 95. Average days on the Market remained steady at 66 in 2021 and 60 in 2022, as did the average sales price from $9,213,653, increasing slightly to $9,618,675. But the ratio between the original listing price and the final closing price edged down a meaningful 2.69%, from 90.56% down to 87.87%.

That may look inconsequential, but it’s not when your average price is $9,618.675. That’s $247,847 in further reduction off the purchase price than the buyer could negotiate the year before. (a lot of mullah!).

The real eye-opener is in the “transaction volume.” Any kind of mega-mansion in Beverly Hills or a small studio condo in Century City can skew these numbers, including $/SqFt. But volume tells a different story because each of us, no matter what our economic station in life, thinks the same way when we watch our stock portfolio dive 20% and the cost of funds more than double. Volume in 2021 for Apr thru Nov was $1,474,184,559, and in the same period, this year’s nose dived to $913,774,134, representing a drop to 62% of the previous year. Westwood and Santa Monica did the same.

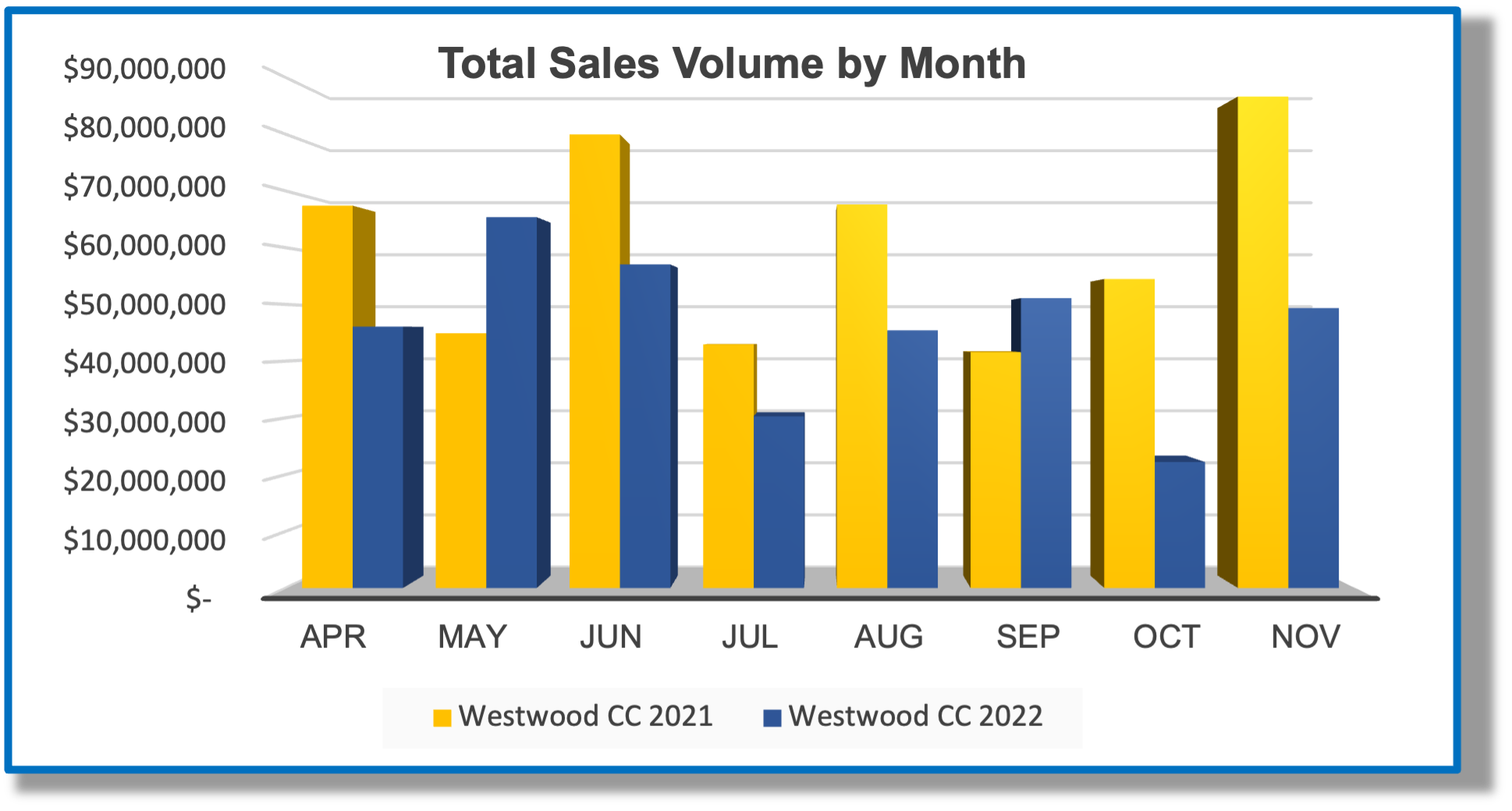

In Westwood and Century City, closed escrows dropped from 142 in 2021 to 112 in 2022. Average days on the Market remained stable, dropping only by two days from 31 to 29, as did the average closing price from $3,208,817 to $3,276,215. But the ratio increased from 97.95% in 2021 to 100.82% in 2022. And volume? It also dropped like Beverly Hills, 19.45% to 80.55% of the volume in 2022 compared to what it was in 2021. ($455,562,600 down to $366,936,169).

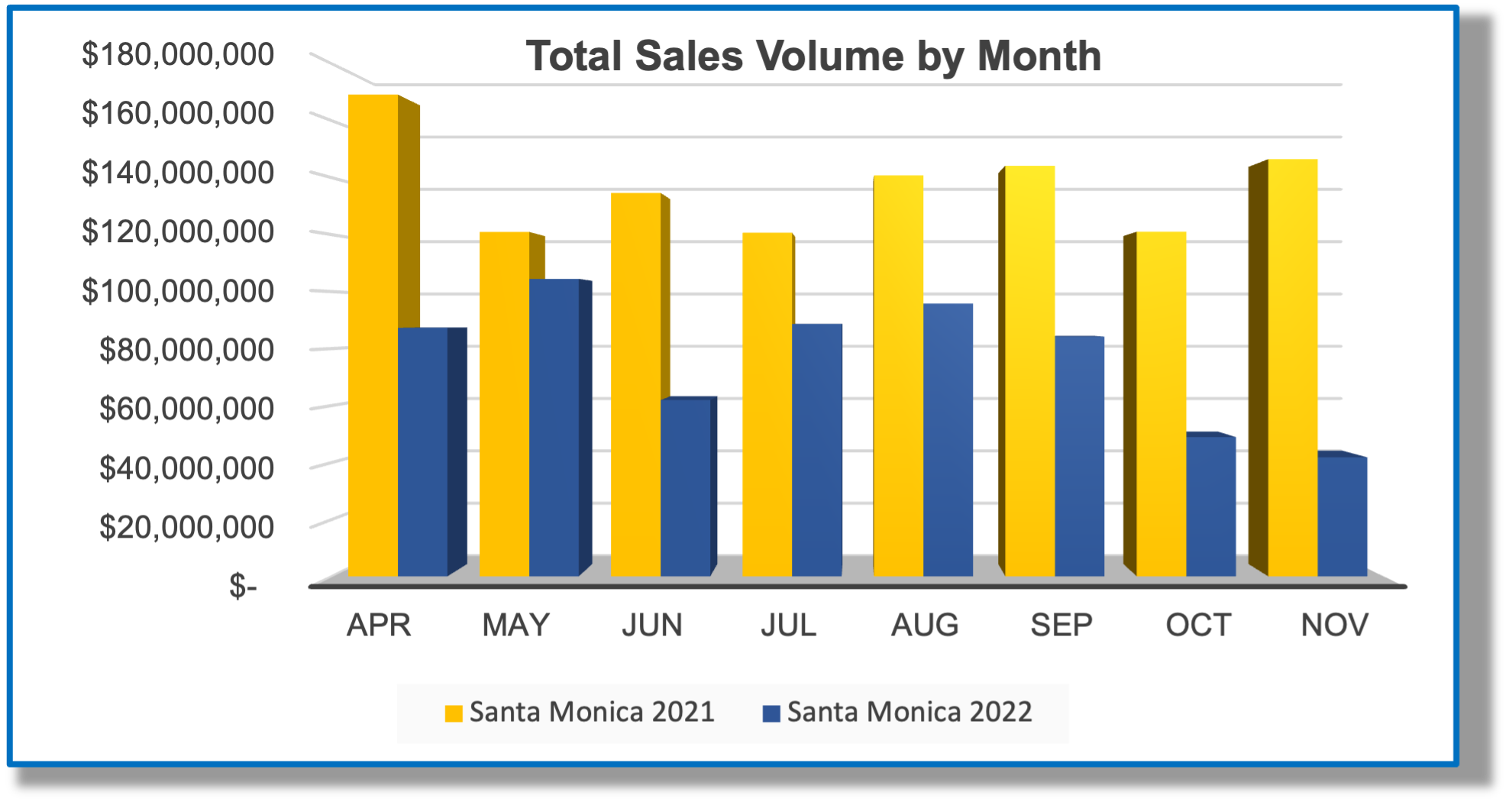

How about the city of Santa Monica? Well, in even more dramatic terms. Their closed sales dropped from 260 in 2021 to 141 in 2022, but their Days on the Market tightened from 36 to 28. The average closing price was stable from $4,224,192 to $4,347,377, showing us that prices held, but the number of sellers putting their homes on the Market dropped since they realized this was not the Market they wanted to be in.

As the figures show, that was not a wise move because the average price remained stable, and the average $/SqFt increased from $1,414.30/SqFt in 2021 to $1,544.30/SqFt in 2022. It all appears in volume, dropping from 2021 to 2022 of $1,098,290,098 to $612,980,218. This made 2022 one of the worse years in recent history, with volume freefalling to a scary 55.81% of what it was the year before. Whatever buyers were out there found they had fewer choices due to the seller’s reticent to sell in this downward Market, resulting in the higher $/SqFt.

Real estate brokers, agents, escrow companies, title companies, and lenders generate their income stream based on dollar volume, not unit volume. This has caused havoc in those arenas, especially if they didn’t plan for it. Compass just opened up a mortgage service Origin Point, for our clients, right smack in the middle of this mess, which is fortuitous because they can start on the right foot with minimal overhead and negotiate some great pricing to attract new talent.

I didn’t research the other communities, but I anticipate you’d see the same results. Again, take a look at the charts. They speak volumes (pardon the pun) on buyers’ leverage in the current environment.

Should I Buy or Sell in a Down Market?

Believe it or not, a down market is the best time to make a move in real estate. You will get less money for your existing property, but you’ll also be able to strike a better bargain on the new property. In addition, your mortgage will be lower (but debt service will be higher temporarily), and your property taxes will start much lower. Overall, in the big picture, you will make a better deal and spend less capital on your most significant asset than if you waited to when you were comfortable at the height of the Market.

Stay positive, test negative, and call us if you have any questions. Thank you.

— Mark Rogo

Beverly Hills

Santa Monica

Westwood

YoY Comparison