The government has ended the emergency mandates covering the COVID-19 virus, and slowly, we are returning to normalcy. But our new normal will never be the same as the old one. Offices remain empty with remote employment becoming more acceptable, the fallacy behind cryptocurrencies has finally been exposed, high-tech stocks are finally feeling the demands of market forces, and the housing market is adjusting to higher interest rates.

We could spend hours discussing these topics, but let’s switch to real estate. Again, I will repeat my old axiom; real estate in West Los Angeles has very little in common with real estate in the United States of America. We are at a landmark point in time. I decided to pull stats on Beverly Hills and Westwood single-family residences (SFRs) and condominiums (CCs) first quarter of 2022 and 2023. My original thought was to focus on units only; that speaks volumes in analysis and offers simple data points to compare.

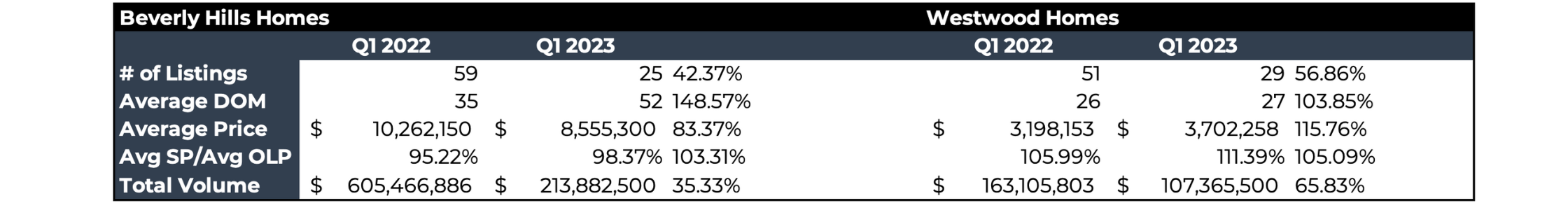

Do you see what I see? In Beverly Hills, the effect of higher mortgage rates are dramatic.

Units in Q1 2023 are 42.37% of what they were a year earlier, and properties remained on the market 48% longer. There was very little change in the negotiations on price, but the total volume dropped by two-thirds.

The same can be said for Westwood. Volume dropped by one-third, which is not as dramatic as Beverly Hills, but still reflects a gigantic shift in the residential real estate business. Unit numbers back this up by dropping from 51 to 29.

That has a rippling effect throughout the economy.

To start with, the county income for transfer fees drops way down. Their step-up basis used in calculating property taxes also takes a nose dive. Corresponding fees to escrow and title and mortgage companies also fall off a cliff and, of course, a drastic drop-off in broker and agent income, resulting in lay-offs. This is the rippling effect of a major holt on a major segment of the economy.

I look upon it as a much-needed correction. The agent community has become too bloated with lazy agents looking to grab the low-hanging fruit instead of working a career.

Market forces displayed their power on Wall Street as well. Compass came out on an IPO a year ago at $17.50/share but now trading at $3.25/share. HOU (Coldwell Banker, Sotheby’s, and Century 21) also has dropped like a rock, from $12.79/share to $5.55/share today, and burned through $2.0B in cash.

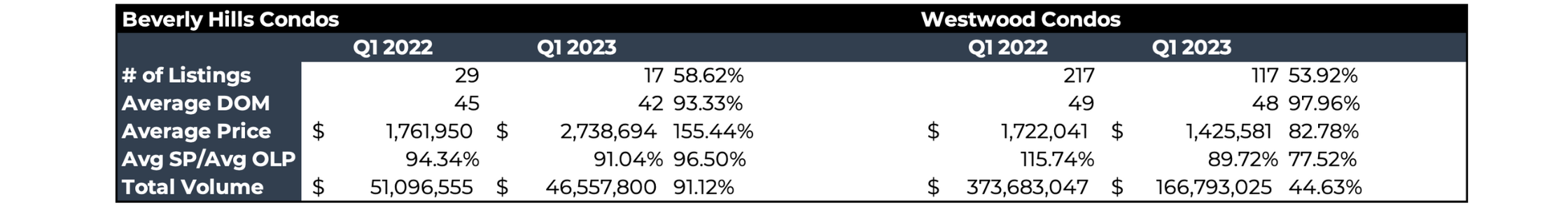

SFRs are dominant, but CCs still play a role, especially in Westwood. Did they follow the same pattern? Let’s look at that data.

A slight shift in the Beverly Hills data trends. While units dropped dramatically, the average price increased by 55% to help stem the loss in total volume to a 9% drop.

Curiously, Westwood condos took an even different turn. Units dropped to 54% of the 217 sold one year earlier, but the average price nose-dived by 17%, which was the opposite in the other three data sets. The negotiations followed the Beverly Hills trend of a 3.5% drop, but much more pronounced to 22.5%. A reduction in units coupled with a major decline in Average Price can only have one result; a huge drop in volume to 44.63% of the previous year.

What’s the message here?

Even though the Westside doesn’t reflect property trends in the U.S., it remains subject to the market forces that govern our lives. Chairman Powell’s colleagues at the Federal Reserve are trying hard to bring about a “soft landing” in their fight against inflation, and that fight has found its way to the Westside of Los Angeles.

The Feds still have another three or four rate hikes in their plans, which can only push the trends further here. If you’re a buyer or seller, you may want to consider this discussion before deciding “when” to pull the trigger.

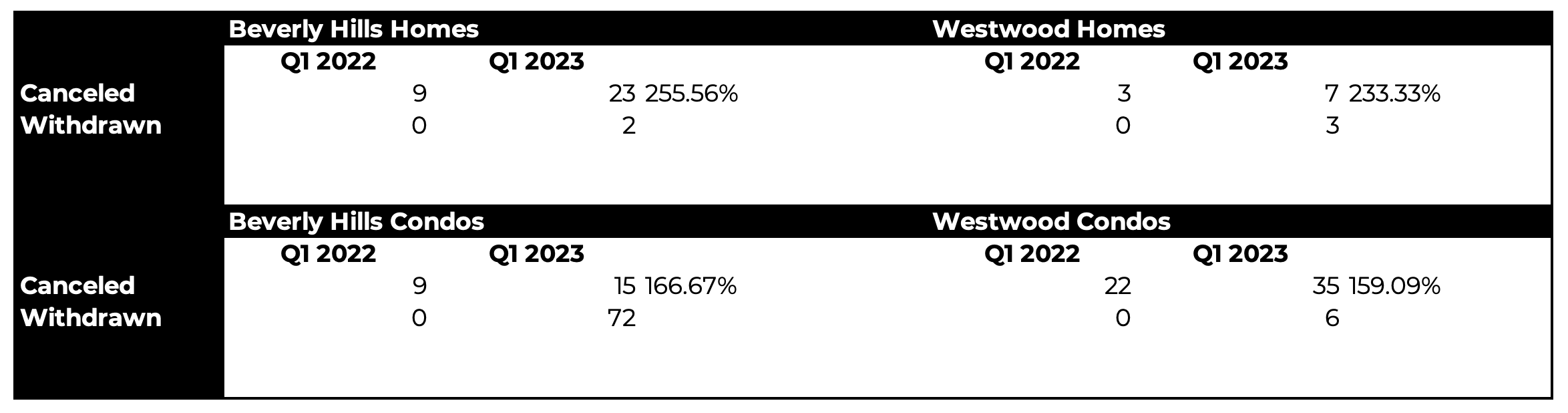

One last set of numbers that will bring the message home about this looming recession in real estate. I also looked at cancellations of listing contracts and withdrawals from the market. Why would a seller cancel an existing listing contract with his agent or withdraw his home off the market? Simple, the seller could see they weren’t getting any traction at their price and weren’t willing to be realistic by lowering it to FMV. So they’d rather leave this market and wait for the next one. They are a very accurate measure of market prodding, and their actions convey that this market is heading south.

I suggest that if you’re a seller and need to sell, now is the time. If you’re a buyer, play hardball because time is on your side.