Ah, the month of February. The 2023 year. So much to say, so much to be proud of, and so much to hope for will fade away in my memory. I’ve never seen a year like 2022, and 2023 is shaping up to be much of the same, with one big glaring exception; the upcoming wedding ceremony for my daughter Marcie.

Let’s start with the most important thing, the passing of Lynn’s Uncle Walter. This will bring a major void in my family from losing a very special man. You can learn more, if you wish, by reading the press statement issued by the Academy of Motion Picture Arts and Sciences. STATEMENT REGARDING THE PASSING OF FORMER ACADEMY PRESIDENT WALTER MIRISCH | Academy Press Office (oscars.org)

Next, let’s look at the real estate market. We all know the basics;

- The Federal Reserve has methodically raised rates, hoping for a precision strike against inflation,

- The stock market remains weak, showing up in depressed portfolios for all Americans, and

- Housing is not exempt from the market forces and is in correction mode nationwide, albeit at different levels in different locations.

On February 21st, the Wall Street Journal reported, “U.S. Home Sales Fall for 12th Straight Month. Sales of previously owned homes dropped 0.7% in January to the slowest level since October 2010…January’s decline marked the longest back-to-back monthly declines on record in figures going back to 1999, NAR said.”

On January 21st, the Wall Street Journal featured a front-page banner headline, “Home Sales Slip to Cap Worst Year Since 2014, ” saying in the article, “Sales of previously owned homes…slid 17.8% in 2022 from the prior year to 5.02 million…December sales fell to … the weakest rate since November 2010.”

Under the headline of “Housing’s Big Hurdle Is Affordability”, the Los Angeles Times reported on January 21st, “This is the biggest challenge the housing market faces this year…An affordability index released earlier this month by the NAR, …rose to 95.5 in November from a multidecade low of 91.3 in October…For comparison’s sake, over the 12 months before the Covid crisis struck, it averaged 162…One way to get back to its pre-pandemic level 162 would be for the average mortgage rate to fall to about 2.6%. Another would be for the prices to fall by about a third. Yet another would be for the family incomes to increase by about 50%.”

These articles talk about the United States real estate market, and I’ve said many times before when it comes to real estate, the west side of Los Angeles is its own country.

Let’s look at the local data, as provided by www.themls.com

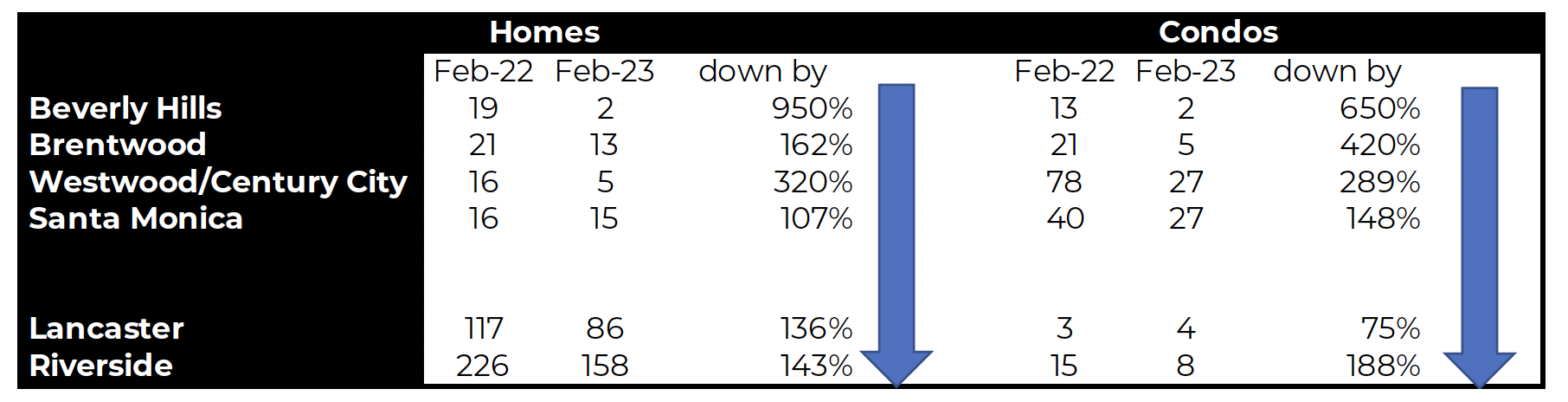

The MLS Data for February 2022 & 2023 showed that unit sales (unit volume) is way off. All brokerages experienced it, the most pronounced of which was Realogy’s (Sotheby’s and Coldwell Banker’s parent company) loss of $480M in the 4th quarter. But how about this for a cross-section of the single-family residence Westside markets;

- Beverly Hills saw 19 closings from February 1st thru the 28th of 2022, but only 2 in the same period of 2023 in single-family residences.

- Westwood saw its volume drop from 16 in 2022 to 5 in 2023.

- West Hollywood stood out among all the communities I checked, increasing from 4 in 2022 to 9 in 2023.

- Culver City saw a drop from 14 in 2022 to 11 in 2023.

Let me tell you about the broker business model. It survives on volume and the ancillary services providing income streams, such as its escrow, title insurance, and mortgage divisions. Realogy is not unique; all major brokerages lost money in the 4th quarter of 2022 and continue to bleed red ink as the rising cost of a mortgage eats into the decisions among buyers to buy. The historically low inventory levels on the west side of Los Angeles only mitigate any severe drop in values (and corresponding $/SqFt). But when I say the sales volume is down, I mean it! I got curious after looking at Culver City, WeHo, Beverly Hills, and Westwood, as I always do. I dug deep into my four bellwether westside communities; Beverly Hills, Westwood / Century City, Brentwood, and Santa Monica. But I also looked at Lancaster and Riverside, just for comparison purposes. For all areas, I looked at unit sales only, the month of February in 2022 and 2023, single-family residences, and condominiums.

There’s a reason I chose February. The new inventory held back in December and put on the market in January can easily stimulate buyer interest and generate more closings in February.

And now, my closing comments will be somewhat controversial. I’ve always been counseled by Lynn and Marcie that these blogs are dedicated to real estate and to avoid politics and religion.

I am concerned for the future of our country, but not for the reasons you may think, such as China’s rising military presence, Russia’s continued aggressive behavior, our failing public school systems, or our fragmented political environment. I am concerned because the younger generations, who are the future of our country, don’t appreciate an evening sitting around the living room just talking or fail to appreciate the wonderment of curling up in front of a burning fireplace with a good book.

That’s why I’m concerned.

I’d love to hear your comments and thoughts, or drop me a line via email and let me know you read this blog. And if you’re eager to learn more, you can further explore my source data sheets by clicking here: Source Data

— Mark Rogo