Real estate is a game of psychology. If you want to be a successful real estate agent and perform your best for clients, you need to master the art of negotiation and the mental prep required. Unfortunately, most agents are not the most excellent negotiators…

So why exactly is negotiation so important in real estate? When you can master the art of negotiation, you can control perception. I’ve been saying this for years, and I’ll repeat it; “The better negotiator will be the one who controls the high ground of perception.”

You won’t find many other events in history that have had the same psychological impact as the Wall Street meltdown two months ago. Rational thought tells you that it’s irrelevant what the market does until the day you buy or sell. But all of us are looking at our statements and shuttering at the loss of market value. We have allowed ourselves to fall back into a defensive situation in our negotiations when The actual job is to take an aggressive stance in a down market and take advantage of others making the wrong decision, which I refer to as knee jerk reaction.

How does this all translate in real estate?

The typical seller looks at the loss in value of his property and starts negotiating backward in his head. The buyer looks at his stock portfolio and lowers his expectations immediately, thinking he’s already lost a boatload of money.

Let’s add one more factor to this crazy scenario.

The federal reserve is raising rates. Now that’s a real-life factor that dramatically impacts a buyer’s ability to qualify at certain levels. Underwriters factor the cost of the loan into the buyer’s ability to pay because they have no appetite for defaults. They’re a small group of 20-somethings who don’t factor in non-employment income, such as property investments or dividends.

Let’s take a real-life example.

A close friend owns a large condo on the Wilshire Corridor, worth $3.5M to $4.0M. He wants to take out a $200,000 loan for an investment. The condo is free and clear, he has no other debts, and he has liquid cash in the form of bank accounts and stocks and bonds more significant than $5.0M. Oh, and FICO scores in the top 5% of the country. You would think receiving approval would be easy; however, He struggled through many requests, documents, and denials. His persistence ultimately prevailed with the patience of a saint, but this shows how the loan process is flawed and probably broken, with no legislative options on the horizon to fix it.

Let’s forget about the numbers and avoid the problems of $/SqFt and Days on Market (DOM). Instead, let’s have some fun and look at the figures that might give us some deeper insight into the mentality of buyers and sellers, considering our economic challenges at this time.

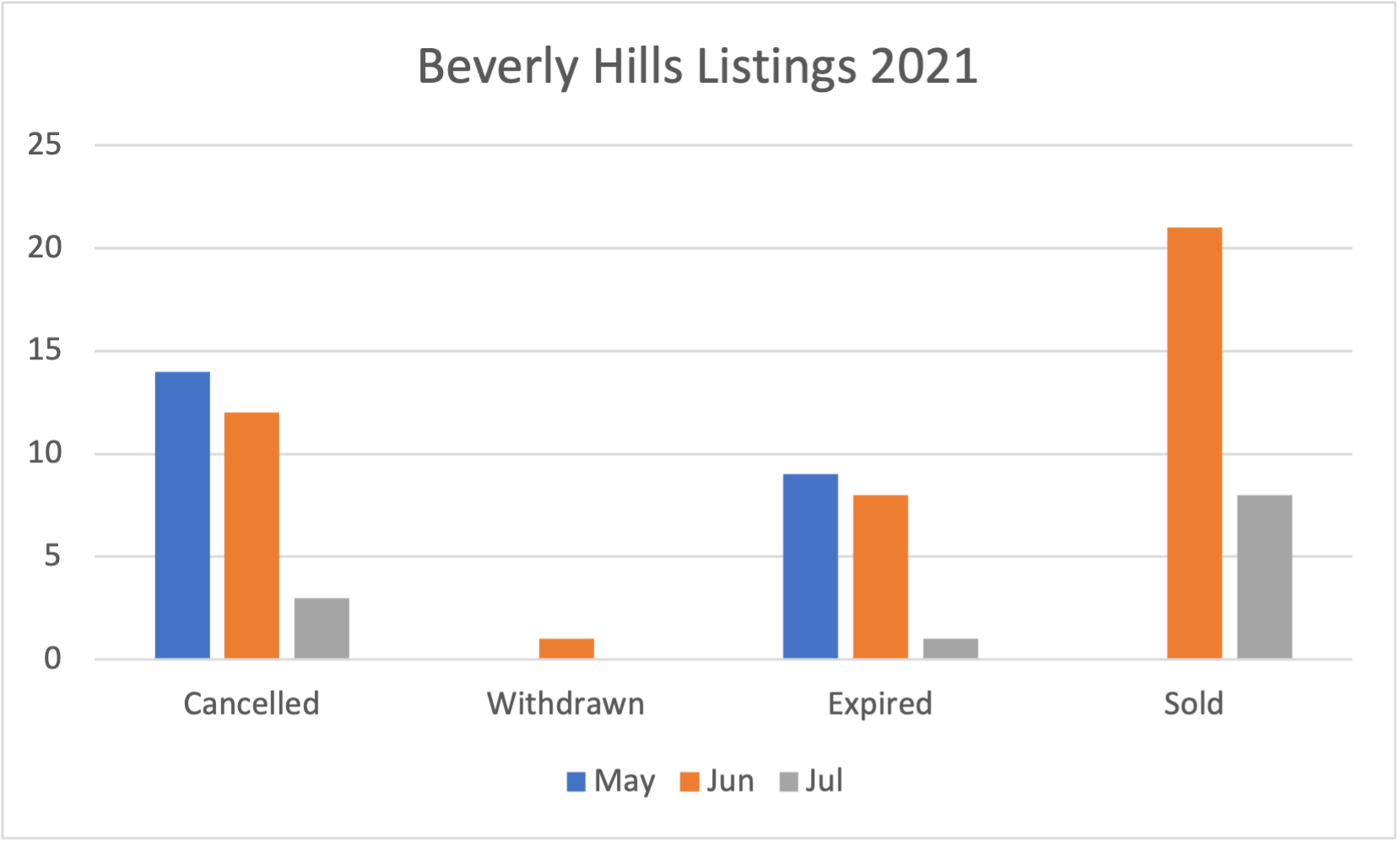

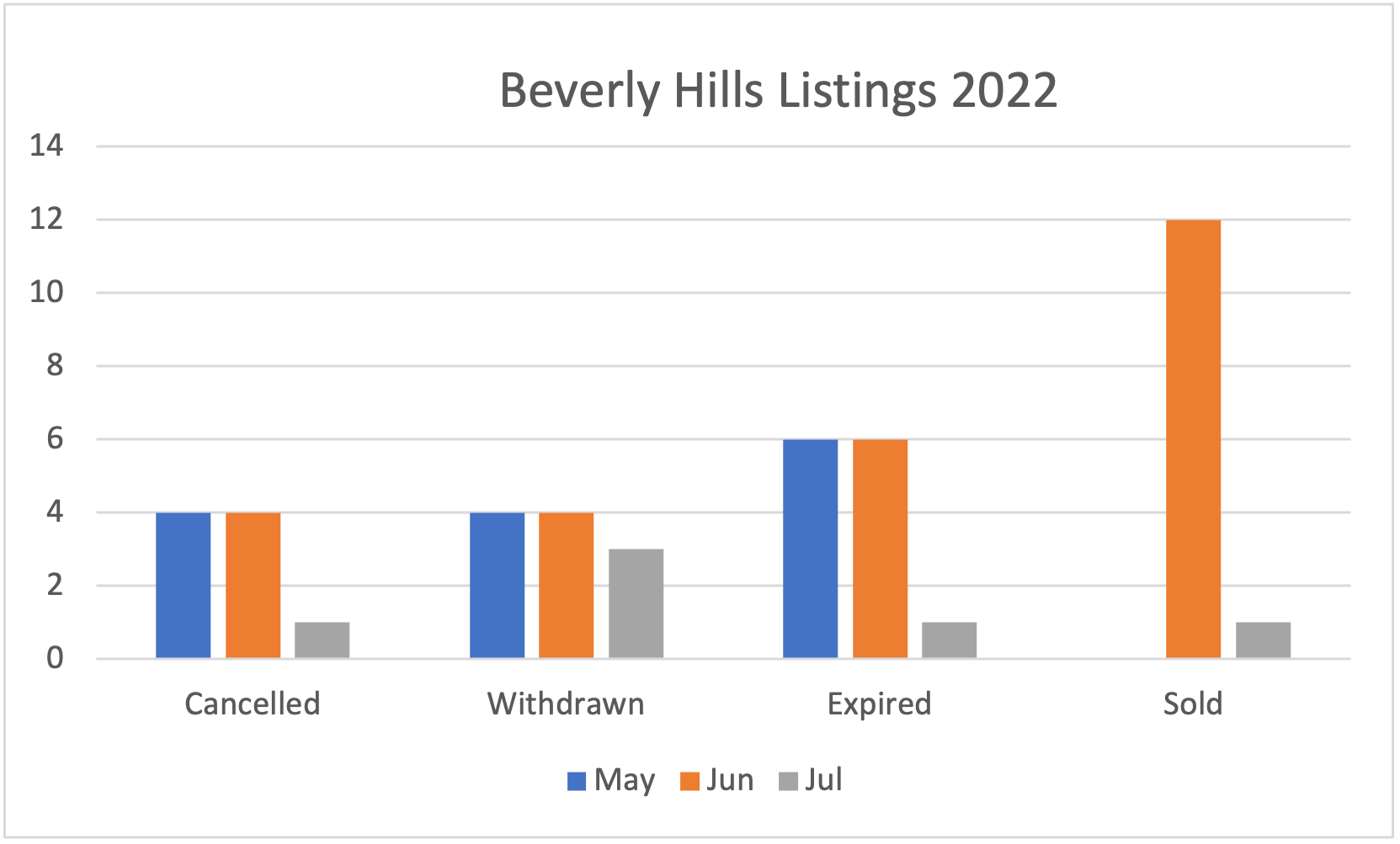

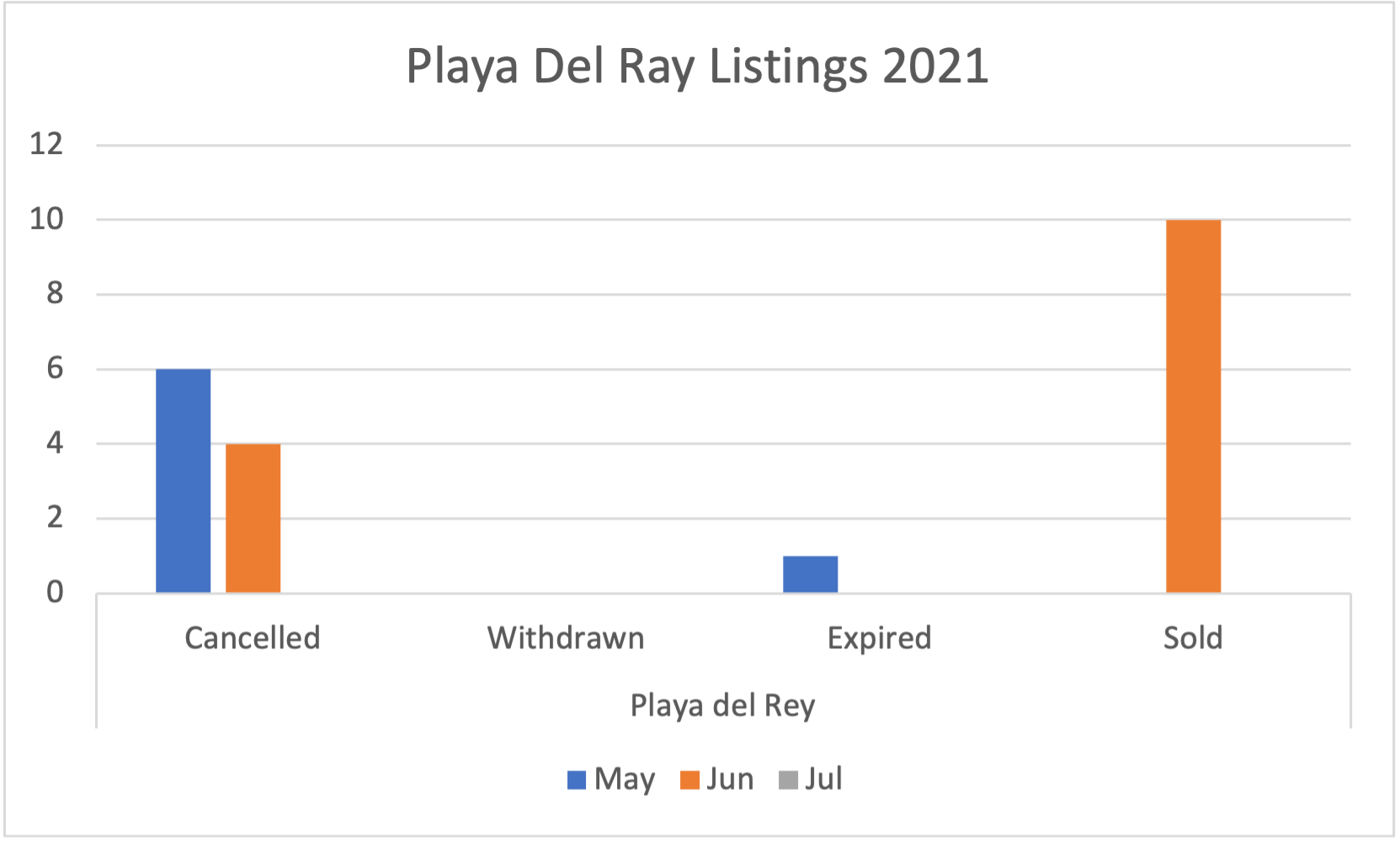

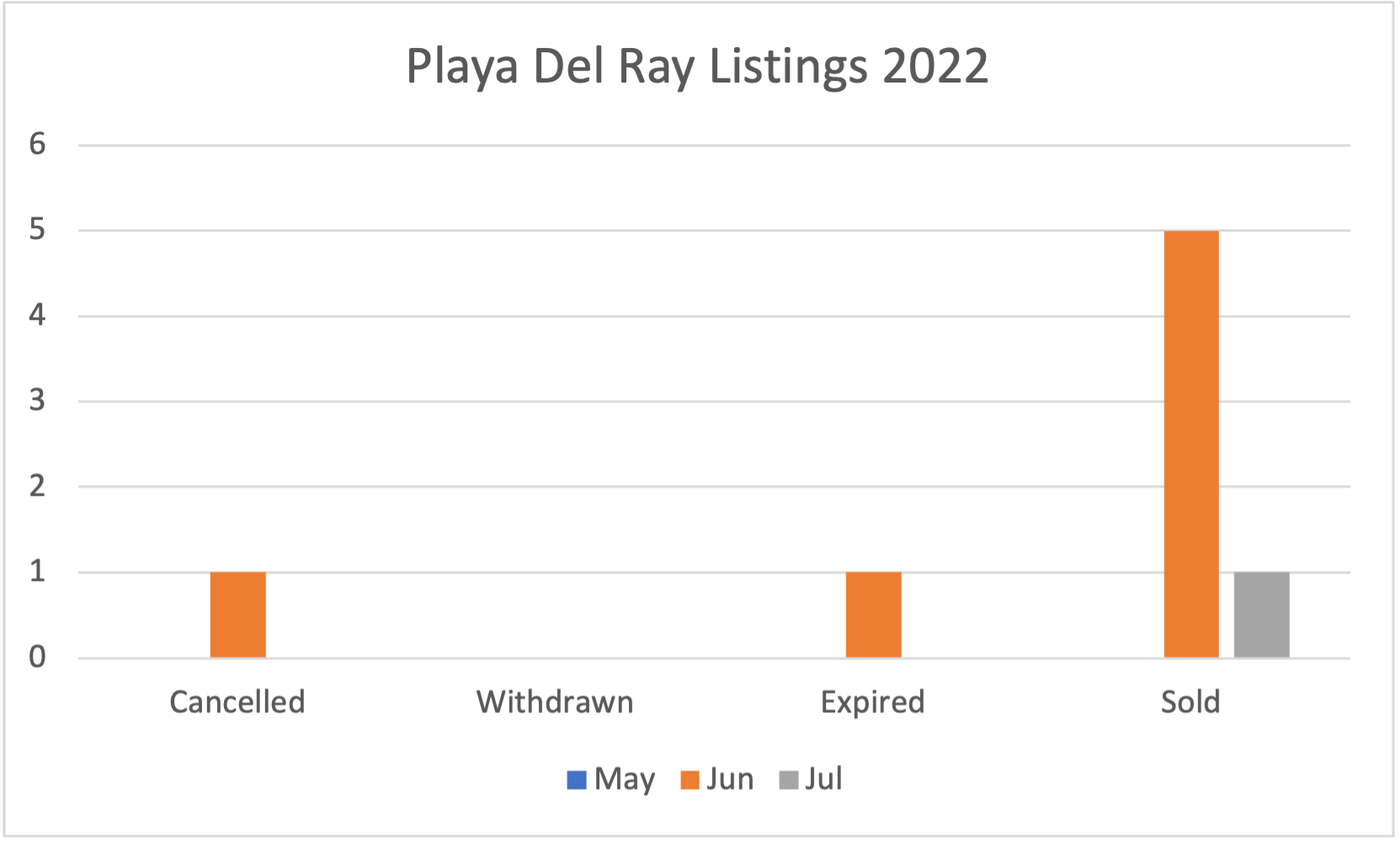

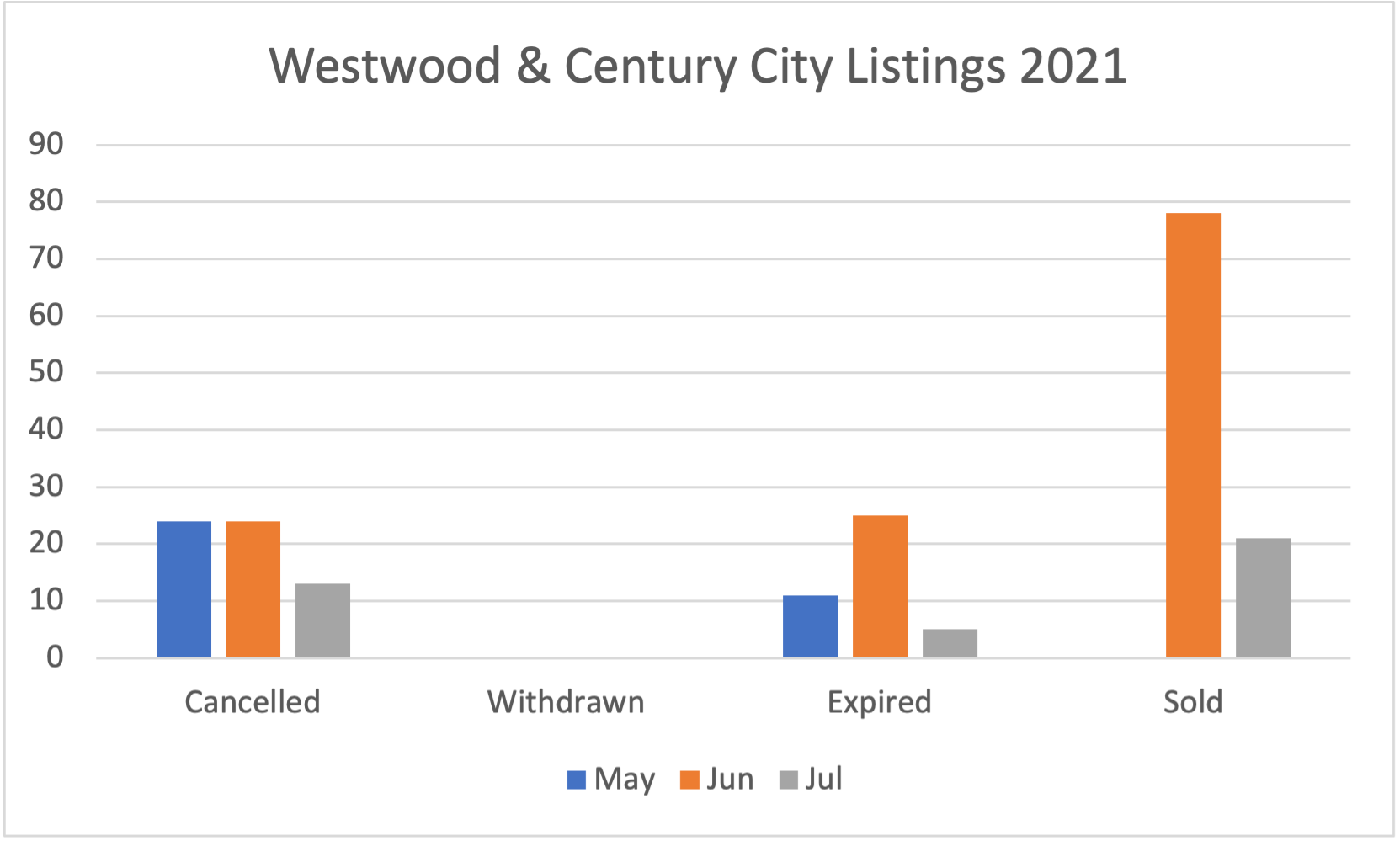

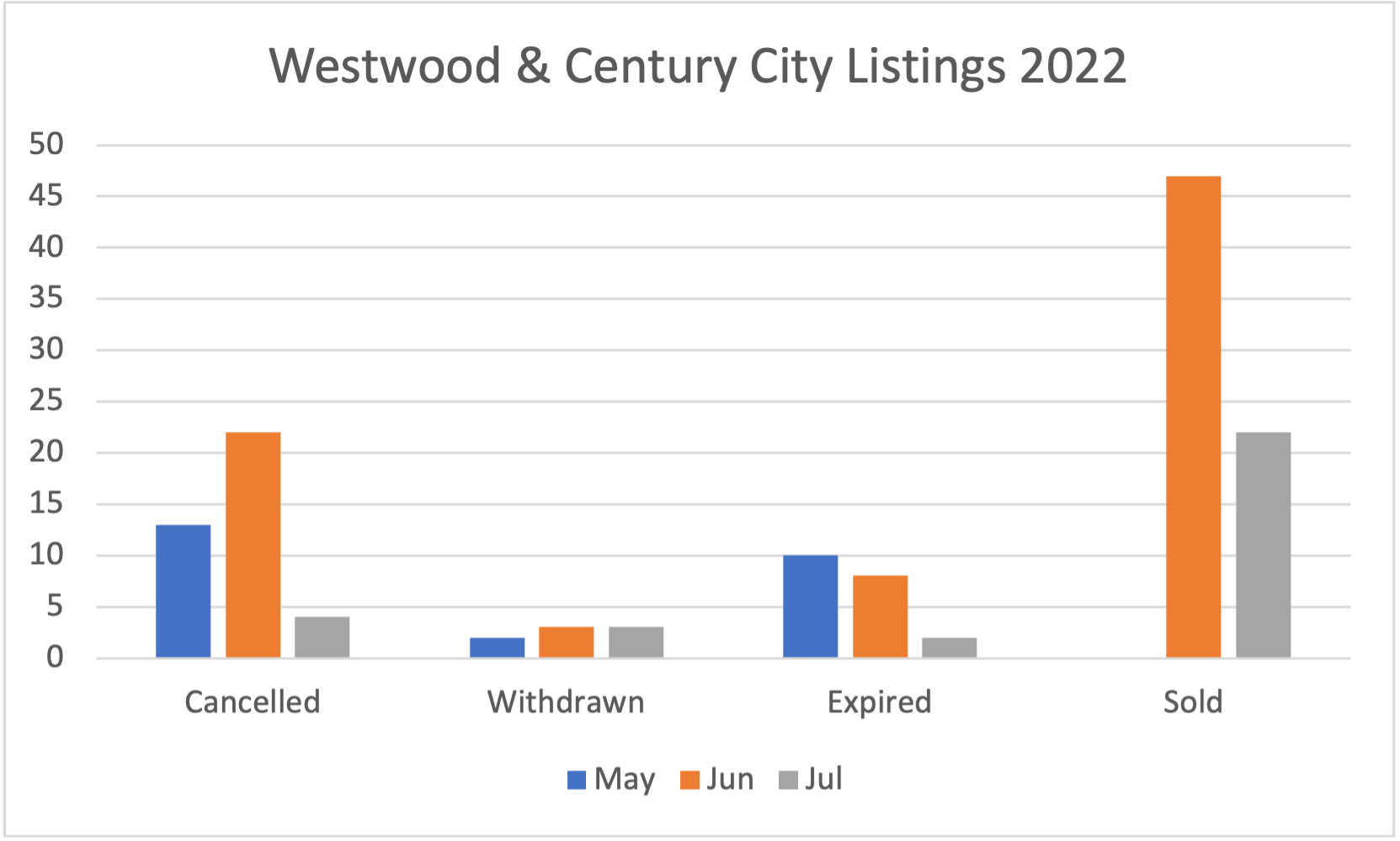

These charts will tell you volumes about the mentality of our clients. Just look at the volume figures, as measured in transactional units. Forget about the dollars. Someone selling their $1,000,000 condo in Westwood is just as concerned looking at his Merrill Lynch statement as the couple in Beverly Hills selling their $15,000,000 single-family residence. This is because they each represent one transaction.

Here are my search parameters:

- Single-family residences in Beverly Hills and Playa del Ray.

- Condominiums in Westwood and Century City.

- May and June were measured in complete months for 2021 and 2022

- July was measured from the 1st thru the 11th

- All data is taken from the CLAW Multiple Listing Service (www.mls.com)

- No filters were used for dollar volume, $/SqFt, DOMs, bedroom or bathroom size, etc. No filters at all.

- The data status categories were “S” (sold), “W” (withdrawn), “E” (expired), and “C” (canceled).

- The data for “Sold” properties were also retrieved in those areas, but only for the entire month of June and July (1st thru 11th) because that date range is an accurate reflection of the mentality behind the decision maker during the pandemic and after the stock market began to crash. As well as comparing the same data from the same date range one year prior. This estimated a 30 to 45-day escrow when that decision was made, but escrow closed in June or early July, which is when it showed up in the MLS database.

It doesn’t take a genius to understand what these graphs tell us. Numbers don’t lie. Volume (as measured by individual transaction units) is way down as buyers pull back on their real estate plans, and closed escrows are in for a deep retreat from the first six months of the year.

Look closely at the volume in closed escrows, but don’t forget that the charts showing withdrawn, expired, and canceled listings also indicate volume changes in their respective date ranges. Escrow companies will see layoffs, real estate brokerage houses will visit agents voluntarily leave as their commissions dwindle to zero, mortgage submissions are already showing a deep decline, and title insurance orders will be way off. In other words, real estate just got very quiet and will remain so into the 2nd quarter of next year.

The moral of the story is that cash is king. If you have cash and are considering a real estate investment, now is the time to make a move on an income property. Get your cost down and refinance later when the rates retreat. From what I read, that will be in Q3 of 2023. Welcome to a market economy under the gods of Supply and Demand.

Mark Rogo

Luxury Estates Director

DRE#: 01423795