There are so many topics to discuss and confusing messages being sent that I’m going to try and tackle some of them in short form here.

First, let’s start with some good news. There is light at the end of the tunnel. Lynn and I are experiencing the largest backlog in our history as real estate agents, meaning we are preparing more properties for the market than we ever had before. We are not the only ones. My managers tell me they can see the same backlog amongst the most successful listing agents in the office. The good ‘ole reliable bell-shaped curve is about to change, and the inventory is about to increase. How much? I’m not sure but my gut tells me enough to make a difference, not enough to put the buyers in charge of the market. If you’re a seller, now is the time to put it on the market.

INVENTORY LEVELS

So many articles about inventory levels are sending mixed messages because you can’t pinhole real estate into one specific geographic boundary. It doesn’t work that way. (I keep saying this, and the WSJ doesn’t listen to me!) There is housing inventory in the United States, then there is housing inventory in California, and then there is housing inventory on the west side of Los Angeles. When it comes to real estate, the west side is a different state and a different country. It’s that simple.

The WSJ (Wall Street Journal) published an article on September 21st titled “U.S. Home Sales Fall for 12th Straight Month”. But on September 13th, they published “House Prices on Rise Again in the U.S.”.

“Home prices aren’t falling anymore. After declining on a year-over-year basis for five consecutive months – the longest run of declines in 11 years – U.S. home prices rose in July. Scarcity is a big reason. High-interest rates have prompted homeowners to stay put rather than buy new homes and take on more expensive mortgages, resulting in an unusually low inventory of homes for sale. The result is a market in which the overall volume of transactions has fallen dramatically. Sales of previously owned homes are now down about 36% from January 2022. But prices are generally holding firm…”

The confusion is centered on the matrix; how do they measure sales or prices, inventory or values, or any other description they use? They all command different data, allowing different conclusions depending on how you slice it up.

It’s very simple and it is a result of misguided tax policies. Inventory (units) are way down to historic lows, Which leaves a large community of buyers chasing fewer and fewer homes for sale. Of course, that results in higher prices (gross selling price) and higher values ($/SqFt). But why is this happening?

- The Mansion Tax aka Measure ULA in Los Angeles and a similar version in Santa Monica were passed by voters to levy 4.5% to 5% additional taxes on homes sold over $5.0M, to address the homeless issue in our communities. Of course, this is going to have a dampening effect on the sales of homes over $5.0M. Why would you expect otherwise? Do I believe these funds will end up in the city’s general fund instead of helping address the homeless problem? You bet.

- The misguided State Proposition 19 that was passed by a general statewide vote to change how property tax laws are calculated on a change of ownership between generations also seriously dampened housing inventory. Children who inherit their parents’ home must make it their primary domicile to claim their parent’s Prop. 13 taxes. As soon as they move out or sell the house, the property tax basis reverts to Fair Market Value at the time of their inheritance with a provision for annual inflation.

- And the capital gains tax. For Federal purposes only (there is no preferred long-term capital gains tax in California), it used to be that your gain was deferred forward to each new property you purchased. For the past 30+ years, the gain on your home (cost + capital improvements + homeowners deduction = basis) is taxed when you sell it. Another major reason NOT to sell your home.

- Do I need even to mention the effect of higher interest rates? Homeowners of any age will be reticent to move if they must give up their 2.5% interest in return for a 7.75% APR. That’s a tough pill to swallow.

Our elected representatives accomplished their goal, which was to raise taxes. These measures generated additional taxes but did nothing to increase the housing stock and allow the buyers more choices. More choices for the buyers mean lower prices and more housing available. This is macro-economic 101.

INCOME IN THE UNITED STATES

The U.S. Census Bureau publishes a fascinating report annually on Income disparity in the United States. It’s really on the income statistics in our country, but the theme comes out loud and clear: income disparity in the United States. In 2021 the 64-page report, and the picture isn’t pretty. The middle class faces economic challenges with stagnant earnings, while the Black community continues to grapple with longstanding issues of racial discrimination and inequality.

Highlights:

- Real median household income was $70,784 in 2021, not statistically different from the 2020 estimate of $71,186

- Based on the money income Gini index, income inequality increased by 1.2 percent between 2020 and 2021; this represents the first time the Gini index has shown an annual increase since 2011

- Between 2020 and 2021, the change in the number of total workers was not statistically significant; however, there was an increase of about 11.1 million full-time, year-round workers (from approximately 106.3 million to 117.4 million), suggesting a shift from working part-time or part-year in 2020 to full-time, year-round work in 2021

- The real median earnings of all workers (including part-time and full-time workers) increased 4.6 percent between 2020 and 2021, while median earnings of those who worked full-time, year-round decreased 4.1 percent

The report also provides graphs showing:

- The median household income for “no high school diploma” is at $30,378 while “bachelor’s degree or higher” is at $115,456. (If that’s the case, why isn’t higher education universally provided to the bottom 80% of society? It’s a cheap investment for higher lifetime taxes garnered by the government through payroll taxes, increased sales taxes from higher consumer spending, and higher property taxes through higher home sales?).

- “Real Median Household Income by Race and Hispanic Origin” shows the Black community falling farther and farther behind with a median household income of $48,297, versus $101,418 for Asian families.

It’s fascinating reading. You can look at the report by going to this Dropbox Folder where I’ve provided several research items: https://www.dropbox.com/scl/fo/ymidbr86yf1jze0imqgmw/h?rlkey=0s11h1zwya79t004bkkurava0&dl=0

WILSHIRE CORRIDOR DATA

Condos are far more sensitive to market forces than single-family residences (SFR). That’s due to a variety of factors, the most important of which is there are far fewer buyers for condos than for SFRs.

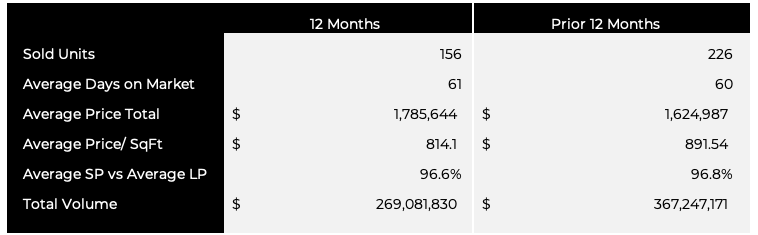

Since our business is 2/3rds condos, I follow that data much closer than anything else, especially along the Wilshire Corridor. Here’s some data to tell you the story along the corridor.

The Total Volume and Sold Units data from The MLS says it all; a gigantic dip in sold units (individual transactions), and a corresponding drop in Total Volume (gross sales). A big part of that is the Mansion Tax and the new property tax calculations. Either way, it’s not good for society, not good for new buyers and not good for aging seniors.

I’m not a lawyer (thank God) or an accountant. Please consult your own advisor for any information pertaining to real estate taxes.

Stay positive and test negative.

— Mark