The year 2023 was an exceptional year for a couple of reasons. First, my daughter got married to a wonderful man. Second, it was a recessionary year for real estate with a huge drop in units sold across the United States and volume (total dollar transactions). In 2023, the gods of supply and demand went to battle with increased interest rates, and they won again.

Unfortunately, this drop was brutal to the agent community, forcing many to seek gainful employment elsewhere or tighten their belt to compensate for diminished commission income. But our training tells us that there are five reasons why someone would be a buyer or seller in all economies;

- Their boss transfers them to a different location in a different city,

- Their kids are getting to school age, and you want that special community for its public schools,

- Their wife is pregnant, and they need more room,

- Aunt Bessy passes away and leaves them a boatload of money,

- They just decided to retire and want to downsize, or

- Someone close passed away and they have the responsibility or desire to sell the house.

These circumstances are the only reason why people became buyers or sellers in 2023. There just wasn’t any room for speculative purchases or upgrades. And yet, Lynn and I saw otherwise, having one of our best years, for a variety of different reasons.

Real estate, by its very nature, is geography-dependent. On the west side of Los Angeles, from Beverly Hills to the ocean, we have some very affluent areas that felt the brunt of the interest rate slaughter. However, the damage was minimized by the continued demand for West L.A. property. Solid middle market areas took the hit and the numbers show it.

There are multiple ways to measure all of this. One is by the number of listings that hit the market, second is by average price, third is by average price/SqFt, and fourth is by total volume.

Our pivot point is the city of Beverly Hills. (All data in this blog are as reported in themls.com.) For purposes of this blog, I looked at houses (single-family residences) and condominiums in Downey, Culver City, Santa Monica, and Beverly Hills only.

Data reported from homes in 2023 show the number of listings was down to 61% YTD of the same window for 2022. The average price dropped 26% from $10,715,728 in 2022 to $7,946,329 in 2023. Average $/SqFt dropped from $2,010.45 in 2022 to $1685.26 in 2023. But the biggest flag in the data was volume; down by 55% from $2,132,430,020 in 2022 to $960,505,812 in 2023.

Culver City was the biggest shocker, with condominium volume down to $114.45M or 28% of 2022 volume. Santa Monica saw a 29% drop to $509.070M among condo sales and Downey fell in line with a 1/3 drop to $28.207M. Homes held up better than condos overall, with Santa Monica dropping 15%, Culver down 24% and Downey down 18.25%.

What about the country’s sales volume as a whole? According to Leonard Steinberg, the Compass Guru, he says,

“Year-over-year, annualized home sales fell 7.3% in 2023, down from 4.12 million in November 2022. Nationwide US home sales may only see a modest uptick in 2024 over 2023’s long-term low….. I see this rising around 15%. (Hopefully more as rates come down and unlock ‘low-rate-addiction’)”

Corresponding to that were increased Days on the Market across the board. Whether it’s houses or condominiums, MLS reported the largest increase in Culver City houses, with an average increase from 17 in 2022 to 32 Average DOMS in 2023 representing an 88% increase. The lowest was Downey, up 16%.

With all of this bad news on volume, why did so many listings experience multiple offers? We had a listing in Brentwood Glen that was priced at $2.5M, had six offers OVER the listed price, and closed escrow last week at $2.8M. How can this happen as the Feds raise interest rates and put a damper on the economy?

Simple; still too many buyers chasing too few properties in a market where inventory continues its slide down. The biggest example, once again, was Beverly Hills, where the 121 homes that closed escrow in 2023 were only 61% of the 199 closing in 2022. Culver City condos were next on the list, with 151 closed escrows in 2023 versus 231 closed in 2022. And Downey condos were the same; 53 closed in 2023, representing only 71% of the 75 closing in 2022. These dramatic shifts have seismic effects throughout our industry, and 2023 saw some of the biggest shifts in recent memory. Their effect can be felt in the ancillary industries that depend on the agent community, such as escrow, title, and mortgage. If transactions are down, then everyone is down.

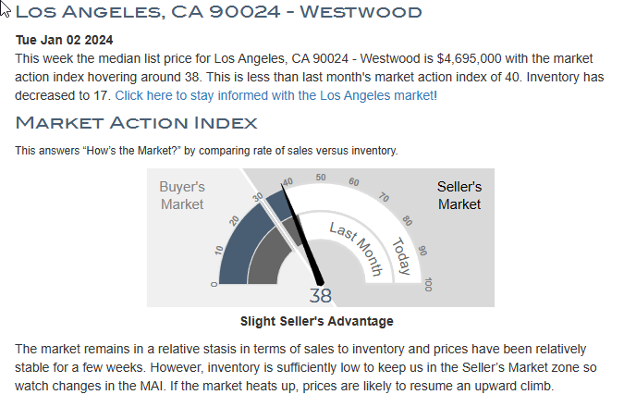

Chartwell Escrow, a subsidiary of Compass, provides a weekly market report on defined geographical areas. It appears each Monday morning in my email box and offers a different view looking forward based on trends and indexes. For the first time in a VERY long time, Chartwell is reporting Beverly Hills buyers have a “Slight Buyer’s Advantage” on their Market Action Index. Not so for Westwood in zip code 90024. There they are calling it a “Slight Seller’s Advantage”.

If you or anyone in your office would like to receive these notices from Leonard Steinberg (daily) or Chartwell Escrow (weekly) I’m happy to accommodate. Just send me the name and email address and I’ll get you registered.

Further on this Blog, the Westwood Village Rotary Club annually focuses one January/February meeting around forecasting for 2024, with a focus on stock picks. Our five or six members who are in the financial sector each give a quick summary of their predictions for the coming year and their top five stocks. If you would like to attend, please let me know. It’s scheduled for Thursday, February 1st at the UCLA Hillel, located at 574 Hilgard Avenue in Westwood. Lunch starts at 12:30 promptly and ends at 1:30pm, although this annual meeting normally goes long because of the interest. Price is $35.00 for lunch, and parking is available at Lot 2 at UCLA on the corner of Westholme and Hilgard. (or you can drive with me).

For real estate predictions in 2024, so far as I can tell:

- The Dow Jones Index will likely exceed 40,000 within six months, largely due to actions by the Feds,

- The Federal Reserve will provide a soft landing with three interest rate reductions at 250 basis points each,

- Therefore, inventory will slightly increase, driven by an increased pool of buyers generated by the rate reductions and an increased pool of sellers willing to sell since loans will be less expensive.

It’s January, and we are entering the peak period for real estate activity; January through April. If you have been waiting to sell your home, give me a call to help you start the process. Today’s savvy buyer insists on viewing properties with visual appeal, or they get lumped into the “major fixer” category. No one does a better job than us to organize the cosmetic upgrades that will make your home shine and pop in the eyes of buyers. Our track record shows the success of our unique marketing strategy.

The year 2023 was an emotional roller coaster for me. I had the high point on April 29th with the marriage of my daughter Marcie to Patrick Friedman Schaffer. The low point was the following morning when my mother passed away. Lynn and I also shared the loss of others; Uncle Huey, Uncle Lito and Uncle Walter. I’m delighted to move on and look forward to a 2024 filled with rate cuts.

Stay positive and test negative.

— Mark Rogo