It’s no secret that the downward spiral of existing home sales is continuing beyond Q1 2025. In fact, just this past Friday, the Wall Street Journal front-page headline reported, “Home Sales See Steepest Decline in 2 Years,” and in another article, “Home Sales in March Fell 5.9% — Biggest Drop Since 2022.” The decline in home sales remains at the top of the news cycle.

How come?

Well, the multi-year decline in sales may be attributed to a number of factors: high interest rates, tax policies encouraging older homeowners to transfer their homes to beneficiaries rather than sell, low inventory which limits choices for prospective buyers—not to mention the costs associated with selling a home. Add to the mix the Los Angeles ULA Mansion Tax and the city/county transfer taxes, and you have scores of reasons to simply stay put.

Single-family residences have taken a hit, but the condominium market is taking a beating. Although The Rogo Group continues to hold fast to our core business of luxury real property sales, we are acutely aware that soaring HOA dues are decimating the high-rise luxury condo scene.

Let’s add insecurity about the future, making us reticent to make major financial moves. We fear the wild gyrations in our Merrill or Schwab accounts, get nervous, hold fast, think twice about selling or moving. It’s déjà vu 2008—when it took a full year after that recession to restore sales of single-family homes, and the recovery of the condo market lagged by five years.

What to do?

Several thoughts come to mind: I maintain—resist selling at a price that you will regret forever. Does that mean holding on to your home or condo unless something like job relocation, divorce, loss, or inheritance comes up? Maybe not, but uncertain times allow for creative solutions. Perhaps converting to income property until the market restores (as it historically has) may be an option worth exploring. Residential real estate is laden with emotion; not so with the commercial side. Home and condo sales have slowed, and for the first time in over a decade, buyers have the edge. Sellers have two choices: drop the price dramatically so the property becomes investment-grade—attracting the bottom feeders—or wait it out.

For over a year, a condo we represent on the Wilshire Corridor has sat idle. The sellers lowered the price by a whopping $500,000, prompting a full-on media blast leveraging all marketing assets: emails, social posts, network boosts, phone calls to agents, announcements at company meetings, eNewsletter footers—you get the idea. Zero offers! Not the result we’re accustomed to. The attached selection of WSJ articles takes a deep dive into explaining this phenomenon—search “Home Sales.”

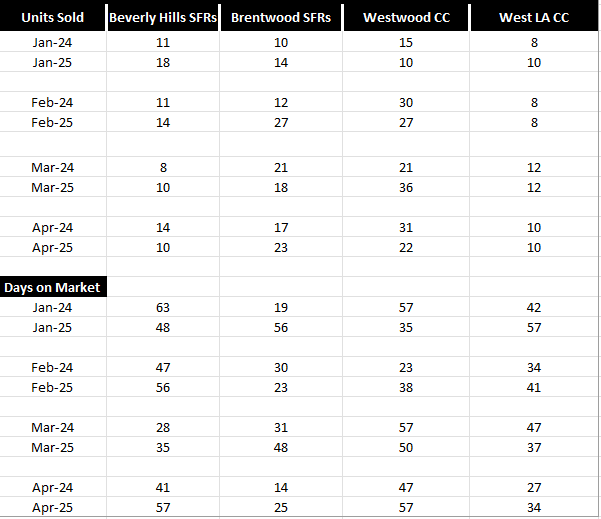

Below is a snapshot of the residential real estate market in the L.A. area. Before you analyze the stats I present from The MLS (Multiple Listing Service), here’s what it indicates: whether it’s a home in Beverly Hills (SFRs) or a condo in West L.A. (CCs), unit sales have dropped to a trickle and inventory is remaining on the market longer—representing opportunity for both buyers and sellers.

Beyond a refuge for ourfamilies, our homes may be our most valuable asset. I feel strongly that if you are selling your primary domicile, inherited property, or investment property—or even if you’re making a move in your estate planning—I urge you to make sure you are getting proper advice from a real estate professional.

The process of selling and buying real estate is complex. The business is replete with data your agent can provide. Be data-driven—analyze and understand it before making your move. The price you reject today just might be a bonanza compared to what you are stuck with tomorrow.

Did I mention I have a new granddaughter?