Within twelve short months the real estate market has done a complete turn around.

Without question this is the best time to sell a home in the last 5 years!

Here’s a couple things to think about. You might be very surprised at what a buyer will pay in today’s market.

If you are interested in moving up this is the perfect time. This could also be the ideal time to make a real estate investment!

Whether you are thinking about buying or selling, Real Estate is very exciting again!

Contact us today to discuss the market in more detail.

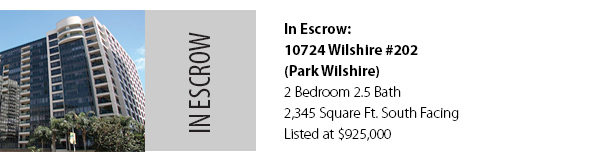

Listed: 920 Westholme, Little Holnmby, CA 90024

5 Bedroom, 3.5 Bath

Listed for $2,495,000

Totally unique Little Holmby Architectural, featuring maple hardwood floors, floor to ceiling glass looking out at the sparking pool, fireplace, dining area, and a kitchen where no expense was spared. Custom made Cottonwood cabinets, Caesarstone counters, Thermador & Miele appliances, “eat around” island, vegetable sink, & many other custom unique features. Zebrawood bar, electric shades, recessed remote controlled lighting, surround sound & speakers throughout. Powder room sink is “pebbles in resin” imported from Italy. Master bedroom with terrace, walk-in closet, bath with steam shower & limestone floors. Direct access, extra-wide, finished 2-car garage with built-in cabinets. Laundry room, alarm system. Outdoor built in BBQ. visit www.920WestholmeAvenue.com

Southern California once again saw strong home price increases last month

as the percentage of absentee buyers hit a record high and cash buyers

remained a dominant force.

A total of 15,945 new and resale homes and condos sold in February — the hig hest volume for a February in six years.

Buyers in Southern California paid a median of $320,000 last month as fewer homes sold in lower-cost Riverside and San

Bernardino counties that have become a haven for investors looking to flip or rent out houses.

“Most every gauge shows prices are up significantly over the past year, even after adjusting for changes in the types of homes selling,” DataQuick President John Walsh said in a statement.

Still, last month’s median price was still well off the 2007 peak of $505,000, Walsh noted.

The median sales price is the point at which half of homes sold for more and half sold for less; it is influenced by the types of homes selling as well as a general rise or fall in values.

Home prices have been on the rise as inventory has tightened significantly and interest rates have remained low. Investors have scooped up many low-priced and bank-owned properties to rent or flip and foreclosures have made up a declining share of homes sold.

Foreclosed homes were 15.8% of the resale market last month, down from 32.6% a year earlier.

Absentee buyers — chiefly investors, along with some second-home buyers — accounted for 31.4% of home sales in February, the highest figure since DataQuick began tracking the figure in 2000. Buyers paying with cash purchased a near-record 35.6% of homes.

Data from the previous two months shows investors playing a major role, Walsh said. But that may be influenced some by the holiday house-hunting season, which tends to skew the buyer pool more toward investors.

“March and April will offer a better view of how broader market trends are shaping up this year,” Walsh said. ”One of the real wild cards will be how many more homes go up for sale. More people who’ve long been thinking of selling will be tempted to list their homes at today’s higher prices.”

As prices rise, more homeowners will escape their negative equity positions, allowing them to sell their homes and potentially loosening supply. “A meaningful rise in the supply of homes on the market should at least tame price appreciation,” Walsh said.