I have a topic to broach with all of my readers that I think you’ll find interesting.

Here’s the question; why do the nerdy underwriters place more importance on an unreliable source of income such as a paycheck in a small firm, than a steady income backed up by government securities and public company dividends? In other words, why would Joe Budweizer look better to an underwriter for a loan just because he can show a paycheck stub from a company that may or may not be in business tomorrow, versus a retired person who has a steady source of monthly income through interest, dividends and rents derived from public companies and prudent investments?

I’ll tell you, I’m really getting tired of hearing how my affluent clients who have developed tremendous portfolios in their retirement are not qualifying for loans like their younger colleagues, just based simply on the evidence of a paystub. A paystub from Joe’s Bar and Grill just doesn’t stand up to a quarterly dividend check from Apple or Ford Motor Company.

How about this little snippet from the Wall Street Journal? “America’s 5th-most populous city, Phoenix also is one of the fastest-growing. Between 2010 and 2019, it saw the highest numeric increase in population of any city, according to the U.S. Census Bureau. Nearly 1.7 million people were living there in 2019. In 2020, 3,233 homes priced $1 million or more were sold in the Phoenix-Mesa-Scottsdale metropolitan area, a 56% jump from 2019, far outpacing other single-family home sales, which saw an 8% growth overall. Overall, prices for the top 5% of the market have surged nearly 40% since 2015.” (WSJ)

Let’s move on to the main subject.

A lot of buyers focus on the monthly HOA dues when considering a full-service building along the Wilshire Corridor. It’s expensive, but that’s what the Corridor offers; lots of assistance, security and amenities to people that want that kind of service.

How do you compare the HOA dues from one building to another? That’s an incredibly complex answer, because each building is different, with different “corporate cultures”, different offerings of amenities, different styles of management, different calculations by the Board, different budgets and different costs. Some have earthquake insurance, others hire third party vendors for the staff, some have 128 units and others have less and even others have more.

The correct method would be to retrieve from management the current HOA dues for each floor plan, the calculations the Board uses to determine those dues and their budgets. Then use the MLS and public records to extrapolate reported closings in a specific window of time.

I’m not going to do that. Too much trouble. Instead, I have downloaded the total condominium closings for the past year as reported in the MLS, and manipulated the data to give me simply the address, HOA dues, and square footage.

This is very unscientific because any deviation from a simple spread of floor plans will warp the results. But something is better than nothing.

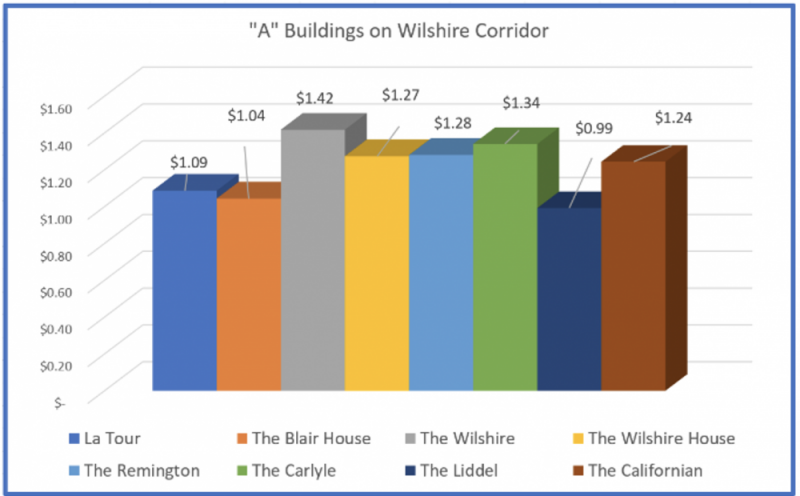

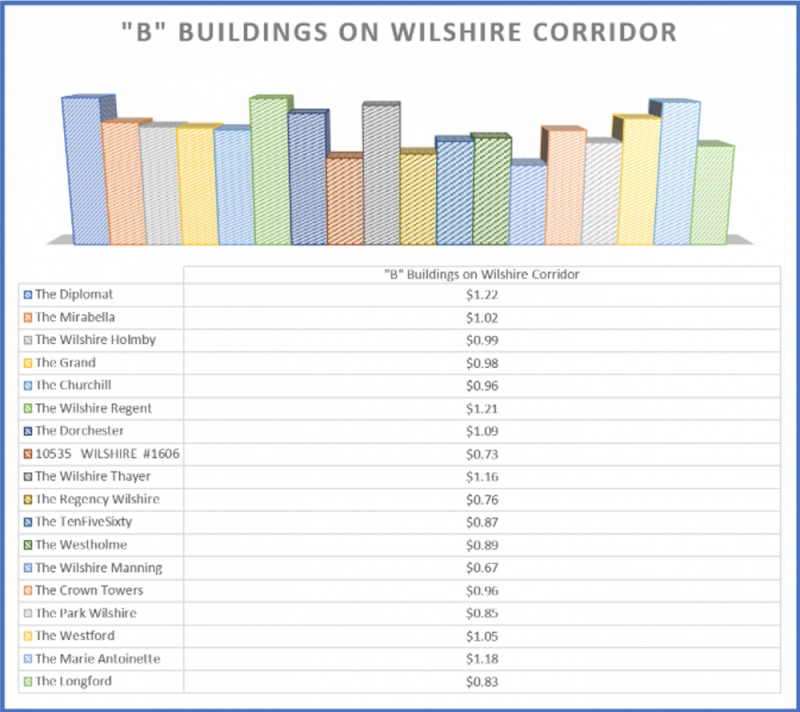

Here’s the rankings; HOA dues as a dollar value to square footage, based on reported escrow closings over the past twelve months. I’ve divided them into “A” and “B” buildings along the Corridor, primarily because the level of amenities and age can be split up into the two categories.

DO NOT use this as a definitive analysis of HOA dues.

There are some messages that can be derived from the data.

First, it’s only a matter of pennies between the lowest and the highest, in terms of $/Sq Ft. So, if you object to high HOA dues, don’t buy a large condo in a luxury high-rise full-service building, or just buy a smaller unit.

Second, so much of this type of evaluation is based on subjective data. One owner may have no use for the swimming pool, the next owner may need it every day for exercise or therapy. Ten or more owners in the Blair House where I live have never permitted the valets to park their cars, but they don’t get a credit on their monthly dues statement.

Third, keep in mind that there is nothing deductible about these dues unless you own an income property. If you can park your own car and bring up your own groceries, why are you living in a building with high dues? There’s only one answer; the view. All high-rise buildings are full service, by the way. But if a desire for the view is not that important, then go buy a condo in a low rise building and save a lot of money.

Finally, if you have strong feelings about the amenities of your condo building and want to see some changes, then run for the Board. Every building in the city struggles to fill Board seats with constructive homeowners who are willing to commit some time to homeowner issues.

We are finally ending this nightmarish visit by Mr. Covid. I hope everyone who reads this is well and safe, and is beginning to think about a gradual return to “normalcy”. But remember two things; use common sense and stay away from situations that may be unsafe. Stay positive and test negative.

And don’t whine about our political situation if you didn’t vote in the Special Primary Election on May 18th. Always exercise your right to vote. My good friend Debbi is working tirelessly to support the voting franchise for all parts of our citizenry in states that don’t share that enlightened view. She has my undying admiration. Take advantage of our more progressive views and vote each and every time there is an election in Los Angeles. It’s your civic duty in a democracy.

— Mark Rogo