Lynn and I just rounded our 90th day as Compass agents. In that period of time we have closed nine escrows, five are in the hopper coming up on the market, three leases were finalized and two referrals. That was a rush of business at the same time we were tackling the cultural shock of being knee deep in a high-tech company doing business in real estate rather than a real estate company operating under the classic “C” Corp model.

Was it Compass that made this happen? No, it was not. At least not directly. I will admit that Compass motivated Lynn and I to wrap our heads around all of the new technology and figure out ways where it would benefit our clients, which had an impact. But at the end of the day, it’s just about the flow of real estate and the needs of our clients.

Compass Concierge and Bridge Loan Programs

Here we go. Compass is launching a series of new programs that are not associated with typical real estate brokerages, but directly address the classic problems many buyers and sellers have in the process of buying or selling residential real estate.

Two weeks ago, Compass launched a bridge loan program. It’s a common problem for buyers; do they sell their house first or buy their new house first? Both have major ramifications both with property taxes and with cash flow. And Compass is eliminating all of the negatives by providing a six-month bridge-loan program where they actually pay the first six months of the loan. During that time, you can negotiate on the home you want to buy and not be stressed by selling your existing property and praying that the money comes in on the sale before it’s due on the purchase. When you sell your house then Compass expects to be paid back, but with no fees or charges other than what they laid out on your behalf.

For several months, Compass has provided agents with a program designed around providing the funds for cosmetic repairs on a home before it’s put on the market. It’s called Compass Concierge and covers all of the cosmetic items that sellers should be doing to their home ahead of time such as painting, new carpets, mold remediation, landscaping and staging. But not everyone has that kind of cash lying around because it can get expensive, even if it does have a huge impact on the ultimate price the home is sold for. Compass will put the money up front with no fees or charges added; they just want you to sign an agreement that you’ll pay them back at the close of escrow. Lynn and I are in the middle of our fifth Concierge project and so far it has been working like a dream. The difference in Fair Market Value is mind numbing.

Investment Choices

Now let’s talk some numbers; my favorite topic. I keep telling everyone that the most efficient use of your investment dollar is in apartments or triplex or duplex buildings. Next are houses and the worse are condos, especially those with high HOA monthly fees. Yet, I still get a regular flow of inquiries from clients who are looking for a good investment in a condo building along the famed Wilshire Corridor, where HOA fees normally exceed $2,000/month.

Let’s look at the numbers. (I love the way that sounds – distinct and to the point). Numbers don’t lie or leave any room for interpretation.

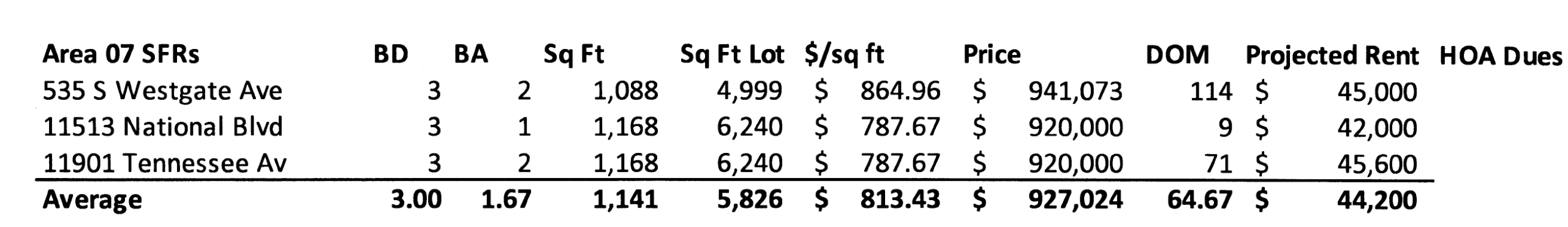

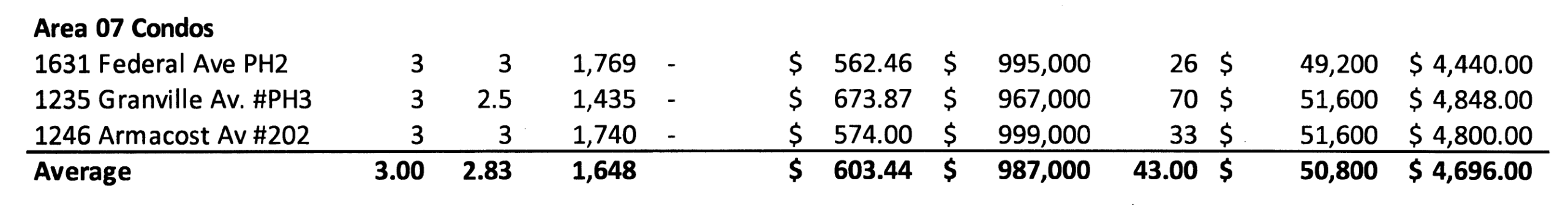

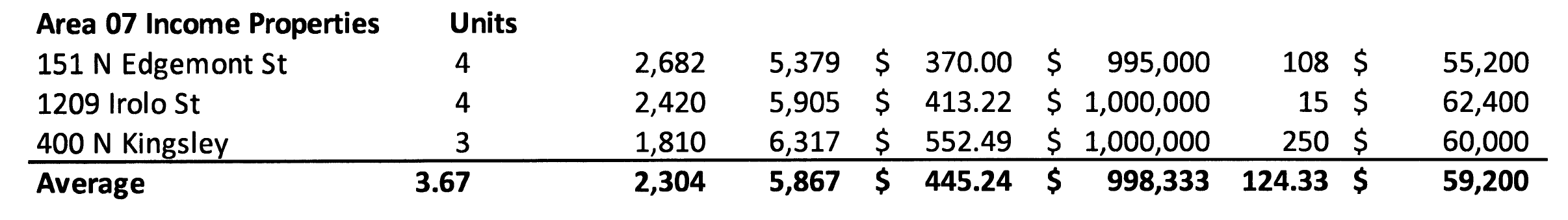

I took one very basic general area in west Los Angeles; Area 07 which is West L.A. but not Westwood of Rancho Park or Cheviot or Santa Monica or Brentwood or Beverly Hills or Palms or Mar Vista. I also tried to keep same-for-same by choosing properties that closed escrow as close to $1.0M as possible, so it would all line up for debt service, property taxes and opportunity costs. Take a look for yourself, but don’t think this sampling is scientific evidence. It’s just validates my conviction that the best real estate investments are the 4 and under unit buildings, with as many bedrooms as possible, within a 30 -minute drive so that you can manage them yourself.

Look at the average projected rents; $44,200 for SFRs, $50,800 (minus $4,696 for HOA dues) for condos and $59,200 for income properties.

It’s really a very simple premise. The smaller you split up the product, the larger $/sq ft return you will get. Whether it’s time shares, pods in a hotel or apartments, the smaller the square footage the more gross dollars you will generate because more people are cutting up that pie.

Factoids about Millionaires

Here are some more fascinating “snippets” from Leonard Steinberg, our guru of inspiration at Compass;

- The world’s 46.8 million millionaires are now worth a combined $158.3 trillion – or 44% of the world’s total wealth. The USA has about 18.6 million millionaires or about 5.6% of the population. A half a billion people are worth $100,000 to $1 billion. The number of people in the world worth between $10,000 and $100,000 has seen the biggest growth of any wealth segment, tripling since 2000 to 1.7 billion people. For the first time, China now accounts for 100 million of the richest 10% of people in the world. There are 99 million Americans in the same category. The share held by the bottom 90% accounts for 18% of global wealth, up from 11% in 2000. (CNBC)

- Of the 618,000 “millennial millionaires” – those currently aged 23 – 37 years old with a net worth of over $1 million – in the USA, 44% are concentrated in California. California also has the highest percentage of business owners (23%) and the highest percentage of real estate investors. New York ranks No. 2, home to 14% of the millennial millionaire population. (CNBC)

- Millennial millionaires make up only 2% of the total millionaire population in the USA, but their wealth and influence will continue to grow ahead of the Great Wealth Transfer. (Luxury Daily)

- In 2019, about 19% of U.S. households with six-figure incomes rented their homes, up from about 12% in 2006, according to a Wall Street Journal analysis of Census Bureau data that adjusted the incomes for inflation. The increase equates to about 3.4 million new renters who would have likely been homeowners a generation ago. (WSJ)

Coming up soon we will have an amazing large unit in Century Woods and a 2BD+loft in Marina Del Rey. Stay in touch with us by following us on Facebook (Mark Rogo – personal) or our company page at www.facebook.com/thewilshirecorridor or through this blog. And stay tuned for our launch of new webpages designed around updated technology and the branding of Compass.