Rent Control, Discount Brokers and

the $5.0 Million+ Market

RENT CONTROL

The voting citizens of California did the right thing; they defeated Proposition 10 which would have established a state mandate for forced rent control on all municipalities statewide. But the fight is not over.

Our elected officials are weak and pathetic. They vote for political expediency rather than on the merits of the issue. Everyone knows that rent control is no replacement for truly affordable housing, which should be a right in this great state rather than a debate. How does that get done? There’s only two ways; subsidized government housing or additional private sector development.

In the March 2019 issue of Apartment Age reports, “It has been widely reported that some housing experts have estimated that the State of California needs about 3.0 million additional housing units to ease our housing crisis.”

The governmental bodies know that subsidized housing carries an incredible price tag to the voters, which is untenable. The cost of the land is unacceptable in high density areas, development costs are beyond comprehension and ongoing maintenance impossible to budget for and subsidize.

Let’s just clarify something here. I’m talking about affordable housing for the working man and woman. I am NOT talking about additional density in the affluent areas or more luxury senior assisted living, such as The Belmont is proposing on the Presbyterian Church parking lot in Westwood. That’s a whole different issue.(see https://www.neighborsforsensiblegrowth.org/ )

Which leaves the politically wrong but morally correct choice to accept the laws of supply and demand. If the cities were to encourage additional housing development through subsidies, a leaner permit process and zoning changes, then more developers would build. If they add more housing stock onto the market, then it increases the choices tenants have, which changes the current dynamics of a landlord-dominated marketplace. More units means more people have housing which means less $/sq ft rent with more competition which means a more level playing field between landlord and tenant. It’s just that simple.

A teenager can figure this out. What’s wrong with our elected officials?

DISCOUNT BROKERS

We are all hearing the TV ads and social media marketing from the discount brokers, making the contention that we are all wasting money on expensive commissions, and they can provide the same services as a full-service broker for a steep discount. Don’t believe it for a second.

For most of us, our home represents the single largest asset on our net worth statement. It really represents a lot more than that. It represents a refuge to our family, the housing of our memories and the latent bank account holding our deferred savings plan (i.e. appreciation) if we need it later on in life. It will probably become the financial legacy we leave behind for our heirs.

So, why would you trust that negotiation to some newly-licensed twenty-something fresh out of college? Discount brokers are exactly that; discount brokers. Their business plan requires they make it up in volume and generate a factory production line to maintain costs with lower income. They try to quantify everything into an automated process to lower costs in a business that does not lend itself to production lines. You are pitting your negotiator’s ability up against seasoned barracudas like myself who have spent a lifetime negotiating all kinds of assets and come to the table with refined negotiating skills. They are no match for us, and the 3% or 4% you are saving in commission expense will be dwarfed by the 10% or 15% you lose in the negotiations. You get what you pay for.

DO NOT think for a second that a discount broker offers the same services as a full service retail broker. It just is not true. Coldwell Banker, Sotheby’s, Century 21, The Agency and others have ongoing continuing education as a requirement of the brokerage, along with teams of attorneys to mitigate any problems that might arise in the course of an escrow, trained staff to oversee the paperwork and multiple layers of management to monitor each transaction. They maintain a very high standard of ethics and have no incentive to retain a top producing agent who steps over that ethical line. (Trust me – I’ve seen it happen; no tolerance for unethical conduct).

Discount brokers try and slice the process into specialized areas in order to automate the process. There might be one person doing showings, another handling inspections, another supervising paperwork and still another doing the negotiations. How are they supposed to fully represent a seller if each one of them has a different relationship with the client, a different understanding of the client’s needs and different “take” on what the client’s strategy is? Do you really want to explain your position to four or five different representatives of the same brokerage at each step of the transaction? When a full service broker enters into a listing contract with a seller, only one or two agents handle the transaction throughout the whole process, and they are privy to all of the discussions, all of the disclosures, and all of the strategy sessions.

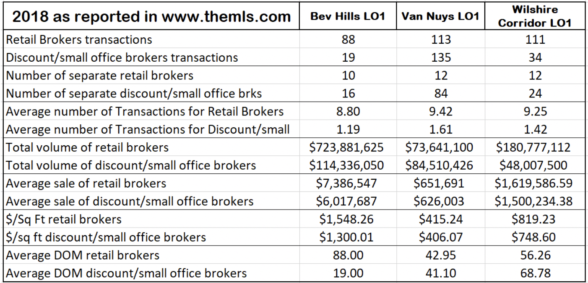

Don’t believe me? Well, you know me by now; I like to look at the numbers. Let’s take a cross section of the greater Los Angeles residential community and look at homes in Van Nuys and Beverly Hills and condominiums along the Wilshire Corridor. Let me prove it to you.

I made my own definitions of what denotes a “Retail Broker” and what denotes a “Discount/small office brokers”. I also used only MLS data from Listing Office 1. The areas chosen represent a cross section of the greater Los Angeles area; the single family homes in “the flats” of Beverly Hills, the single family homes in Van Nuys and the Condominiums found along the Wilshire Corridor in Westwood.

Go ahead and arrive at your own conclusion, but it appears to me that any market share gained on the lower end will only result in inexperienced agents handling your negotiations. We can arrive at a variety of conclusions and this is certainly not meant to be a statistically sound test. It’s only a snapshot of data that undermines my conviction that discount brokers are NEVER in your best interests, under any circumstances. To do otherwise is to shoot yourself in the financial foot; your property will be on the market longer, you will get less money and achieve a lower $/sq ft.

THE $5.0 MILLION + MARKETPLACE

The numbers are in for 2018 as reported in the MLS. Tom Dunlap, manager of the Coldwell Banker south office in Beverly Hills cautions us though; “We estimated that there may be an additional 20% of shadow “off-market” inventory, so keep that in mind when reviewing these numbers.”

There were 580 total closed sales in 2018 valued at $5 million and above

• 352 between $5 mil and $9,999,999

• 157 between $10 mil and $19,999,999

• 43 between $20 mil and $29,999,999

• 19 between $30 mil and $39,999,999

• 9 over $40 mil

There are 491 total active listings valued at $5 million

and above in the MLS

• 272 between $5 mil and $9,999,999 – approx. 11 month supply

• 128 between $10 mil and $19,999,999 – approx. 12 month supply

• 45 between $20 mil and $29,999,999 – approx. 13 month supply

• 19 between $30 mil and $39,999,999 – approx. 28 month supply

• 27 over $40 mil – approx. 36 month supply

Finally, Coldwell Banker in their infinite wisdom has decided to remove The View magazine from the Saturday Homes section of the Los Angeles Times, along with Open House listings. Not to despair! If you want us to email you the Open House list each Friday night, we are happy too. Just send us your email and we’ll add you to the list!

See you next month!